What is GST

Goods and Services Tax (GST) is a huge reform for indirect taxation in India, the likes of which the country has not seen post-independence. GST(Goods and Services Tax) will simplify indirect taxation, reduce complexities, and remove the cascading effect. Experts believe that it will have a huge impact on businesses both big and small, and change the way the economy functions.

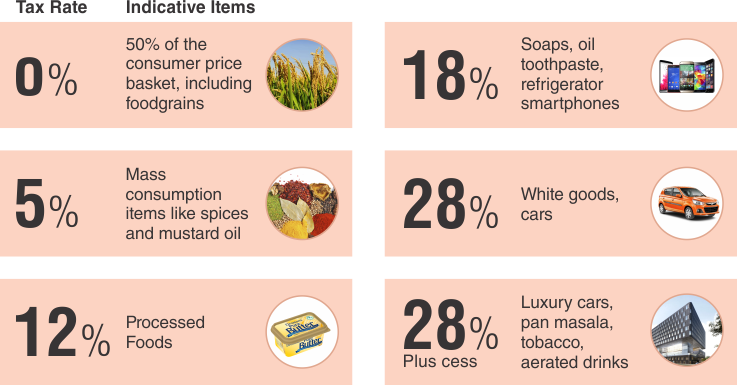

The Goods and Services Tax is governed by a GST Council and its Chairman is the Finance Minister of India. Under GST, goods and services are taxed at the following rates, 0%, 5%, 12% and 18%. There is a special rate of 0.25% on rough precious and semi-precious stones and 3% on gold. In addition, a cess of 15% or other rates on top of 28% GST applies to a few items like aerated drinks, luxury cars and tobacco products

GST vs. Current Indirect Tax Structure

To understand GST(Goods and Services Tax), it is important that we understand the current indirect taxation system. Direct taxes such as income tax are borne by the person liable to pay the tax; this means that the tax burden cannot be shifted to anyone else. The liability of indirect taxes, on the other hand, can be shifted to another person.

So, the person liable to pay the tax can collect the tax from someone else and then pay it to the government thus shifting the tax burden. The GST tax falls in this category.

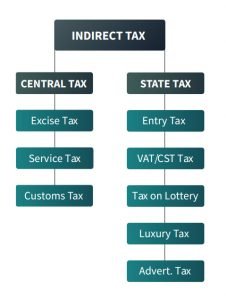

The current indirect tax structure, which comprises of so many different taxes, can be classified as:

Central taxes: levied by the Central govt (includes Central Sales Tax, Excise Duty etc.)

State taxes: levied by the various state governments (VAT, Service Tax, Octroi)

The current indirect tax has one major problem – the cascading effect. When you buy something, you pay a tax on the tax itself.

Why was GST established?

The GST is established to incorporate various indirect taxes which were earlier taxable at different levels. The idea was to reduce red tape, plugging leakages to pave the way for a transparent indirect tax regime.

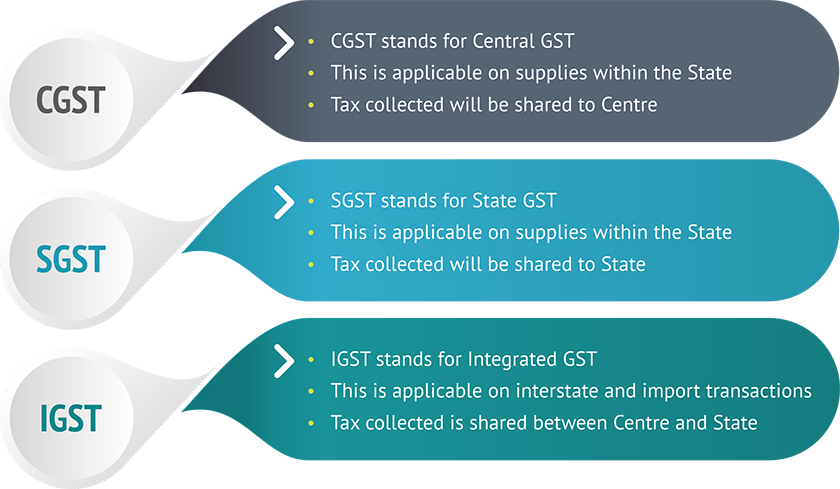

What are CGST, SGST and IGST?

India is a federal democracy that is one which has a clear demarcation of powers, responsibilities and revenue collection between the states and the centre in its constitution. For example, law and order fall under the state’s jurisdiction while the nation’s defence is the centre’s responsibility.

The Central GST or CGST is the area where the centre has the powers and the State GST is where the State has taxation capabilities. The IGST or Integrated GST is for the movement of goods within the states of the Indian Union. This will be collected by the union, however, will be transferred over to the states. Thus it is essential that if and when the GST comes out it is rolled over in the entire nation simultaneously.

Example

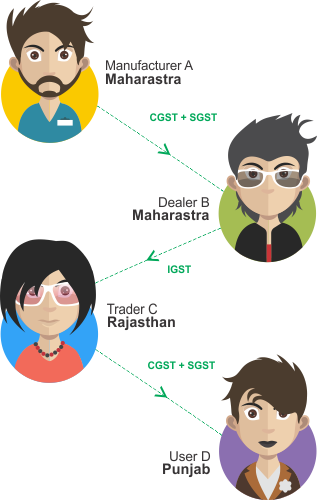

First of all, Suppose goods worth INR 10,000 are sold by manufacturer A in Maharashtra to Dealer B in Maharashtra. B resells them to trader C in Rajasthan for INR 17,500. Trader C finally sold to End User D in Rajasthan for INR 30,000.

Suppose CGST= 9%, SGST=9%. Then, IGST= 9+9=18% Since A is selling this to B in Maharashtra itself, it is an intra-state sale and both CGST and SGST will apply, at the

rate of 9% each.

B (Maharashtra) is selling to C (Rajasthan). Since it is an interstate sale, IGST at the rate of 18% will apply.

C (Rajasthan) is selling to D also in Rajasthan. Once again it is an intra-state sale and both CGST and SGST will apply, at the rate of 9% each.

*** Any IGST credit will first be applied to set off IGST then CGST. The balance will be applied to set off SGST. Since GST is a consumption-based tax, i.e., the state where the goods were consumed will collect GST.

By this logic, Maharashtra (where goods were sold) should not get any taxes. Rajasthan and Central both should have got (30,000 * 9%) = 2,700 each instead of only 2,250. Maharashtra (exporting state) will transfer to the Centre the credit of SGST of INR 900 used in payment of IGST.

The Centre will transfer to Rajasthan (importing state) INR 450 as IGST credit.

What it means for India

1) It gives the country one uniform tax and no frequent rate changes

2) A lower tax burden. One market to help businesses. No truck queues at state borders

3) GDP could rise by 2%

4) Less scope for evasion, which means higher revenues

5) Lower taxes to boost exports

6) Inspector Raj will ease its grip

The concerns

1) Multiple tax slabs mean lesser gains and disputes over classification

2) Multiple registrations in different states

3) Confusion over how the tax will work, as well as filing

4) Apprehension of existing stocks

5) Fears of anti-profiteering unleashing Inspector Raj

What it means for businesses

1) No fear that a state will randomly raise taxes

2) Transparency in taxes

3) Easy because there is only one tax to account

4) Automated process means less babudom

5) Goods and services providers will get the benefit of input tax credit for the goods used, effectively making the real incidence of taxation lower than the headline taxation rate.

And most importantly, what it means for you

Only rates of selected goods and services have been mentioned here.

For more information visit A Quick Guide to India GST rates in 2017

GST rate on pearls, precious or semi-precious stones, diamonds (other than rough diamonds), precious metals (like gold and silver), imitation jewellery, coins – 3%

GST(Goods and Services Tax) rate on rough diamonds – 0.25%

What will be the short-term impact of Goods and Services Tax?

The GST will fuel inflation for the short term. The Goods and Services Tax rate starts at 5% and 18% taxation. Services like restaurants, movies etc. are going to increase prices. Another problem with the GST that many pundits feel is not including liquor and petroleum under

GST’s ambit.

These are major revenue sources for the government and we feel this is being done for a few crony capitalists who need some time to funnel away their black money as the GST

(Goods and Services Tax) promises to widen the tax-paying population.

What will become costlier and cheaper?

According to experts, these items could become costlier:

- Cigarette prices are likely to go up as the GST rate for tobacco will be higher than current duties

- Commercial vehicles like trucks will become costlier

- Mobile phone calls may get costlier as service tax will go up

- Textile and branded jewellery may become costlier

And these could become cheaper:

- Auto: Prices of entry-level cars, two-wheelers, and SUVs may fall

- Car batteries likely to get cheaper

- Paint, and cement prices likely to fall

- Movie ticket prices are likely to fall as entertainment tax will come down

- Electronics items like fans, lighting, water heaters, air coolers, etc. will get cheaper

GST is not just a tax change. It is a ‘behaviour change’ and its successful implementation will depend on how well we as a nation adapt to the new requirements of doing business. Post the initial teething troubles, we can expect that GST will bring in much good for all sectors, including the FMCG industry.

For a detailed overview of GST please visit GST in India

Please let me know if you like the post on GST and do comment for questions or suggestions.

Comments